London, November 30, 2025

The Office for Budget Responsibility (OBR) accidentally published the Chancellor’s Autumn Budget report online on November 26, 2025, prematurely revealing detailed fiscal measures and economic forecasts ahead of the official announcement. The early release exposed tax increases, public spending rises, and welfare policies, igniting scrutiny over fiscal transparency and political messaging.

Details of the Premature Release

The OBR report, intended to accompany Chancellor Rachel Reeves’s formal Budget statement, was made publicly accessible several days ahead of schedule. This unprecedented leak disclosed the full scope of the economic and fiscal outlook, including controversial tax and spending policies that had not yet been formally unveiled.

Tax and Spending Measures Disclosed Early

The early release revealed significant tax changes expected to yield billions in additional revenue. Notable measures include increases to dividend, property, and savings tax rates generating £2.1 billion, adjustments to salary sacrifice pension contributions amounting to £4.7 billion, and a new mileage charge targeting electric and hybrid vehicles set to raise £1.4 billion. Gambling tax reforms and modifications to capital gains tax for employee ownership trusts are projected to add £1.1 billion and £1 billion, respectively.

On the spending side, the budget includes several welfare measures costing around £9 billion by 2029-30. These provisions reverse prior cuts to winter fuel payments and health-related benefits (£7 billion) and remove the two-child limit, signaling a shift in social policy emphasis. Additionally, departmental budgets will see an average increase of approximately £6 billion annually throughout the Spending Review period.

Economic Forecasts and Their Implications

The OBR also published revised economic growth forecasts, projecting real GDP growth at 1.5 percent in 2025. This figure exceeds the March Economic and Fiscal Outlook’s previous projections by 0.5 percentage points, indicating a more optimistic economic trajectory than earlier anticipated.

Context of Controversy Surrounding Fiscal Transparency

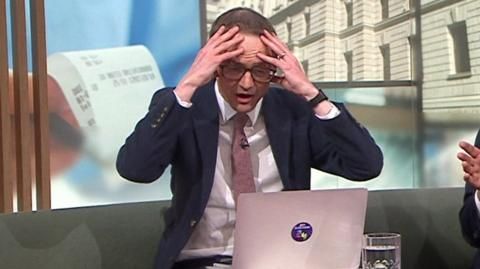

The premature disclosure has occurred amid mounting controversy over Chancellor Reeves’s representation of the UK’s fiscal position. The OBR confirmed it had informed the Chancellor as early as September 17 that the fiscal deficit had improved, with an elimination of the deficit by October. These developments challenge previous claims of a significant funding gap used to justify recent tax increases.

Critics argue that the budget narrative may have been shaped to exaggerate fiscal challenges, raising questions about transparency in the UK’s fiscal policymaking. The early release by the independent OBR highlights tensions between official fiscal assessments and the government’s public messaging strategy.

Implications for Policymakers and the Public

The accidental publication of the budget details ahead of time undermines conventional protocols for fiscal announcements and complicates the government’s communication strategy. It places emphasis on the need for clear, accurate portrayal of economic data to maintain public trust and informed policy debate.

As the government responds to this breach, scrutiny over budget policies and fiscal honesty is likely to intensify among business leaders, policymakers, and academics. The incident underscores the critical importance of transparency and the role of independent institutions like the OBR in ensuring accountability in fiscal governance.