London, December 08, 2025

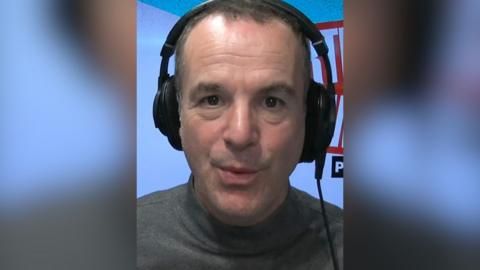

Martin Lewis, widely recognized financial expert, has clarified widespread misunderstandings about credit scores, emphasizing that they are not a single definitive number and advising against excessive concern over minor score fluctuations. This guidance comes amid growing confusion among borrowers about how creditworthiness is assessed.

Understanding Credit Scores: No Single Universal Number

Credit scores, often viewed as a straightforward indicator of financial reliability, are more complex than commonly assumed. Lewis points out that multiple credit reference agencies—including Equifax, TransUnion, and Experian—each calculate credit scores differently. For instance, Equifax scores may be out of 1000 or 700, TransUnion typically scores around 710, and Experian’s scale can reach up to 999. Adding to this complexity, lenders rarely rely solely on these publicly available scores; instead, they deploy proprietary, often confidential scoring systems to evaluate potential borrowers.

This variability means that the concept of one universal credit score for an individual does not exist. As a result, consumers should view their credit scores from agencies as rough indicators rather than fixed measures of creditworthiness.

Minor Score Fluctuations Are Normal

Lewis warns that small changes in credit scores—such as a 20-point drop after closing a credit card—are normal and should not trigger alarm. These minor variations often occur due to routine updates in credit records and can be interpreted differently by lenders depending on their assessment models. Rather than fixating on every point change reported by credit agencies, borrowers should monitor significant shifts or negative financial events that have a clearer impact on credit risk.

Lenders Consider More Than Just Credit Scores

Beyond credit scores, lenders use a broad array of factors to determine financial risk. These include income levels, total outstanding debt, debt-to-income ratios, and even qualitative evaluations such as the borrower’s overall profitability or desirability as a customer. Because many of these elements are internal to lenders and not reflected in public credit information, relying solely on credit scores provides an incomplete picture of one’s borrowing profile.

No Official Credit Blacklist Exists

Contrary to some beliefs, there is no formal “credit blacklist” maintained by any agency or lender. While individuals with poor credit histories may face application rejections, this is due to lender discretion rather than an official ban on borrowing. Martin Lewis emphasizes that credit denial decisions reflect risk assessments and lending policies rather than any permanent exclusion from credit markets.

Focus on Significant Financial Behaviors, Not Score Obsession

Lewis advocates for a broader perspective on credit health by prioritizing major financial behaviors over minor score changes. Borrowers are encouraged to watch for substantive credit events—such as defaults, bankruptcies, or consistently missed payments—that materially affect lending decisions. Treating credit scores as one part of an overall financial picture, rather than an absolute rule, can reduce unnecessary anxiety and foster better financial planning.

By debunking myths and clarifying how credit scoring truly operates, Martin Lewis’s insights provide valuable guidance for business leaders, policymakers, academics, and informed citizens navigating increasingly complex credit landscapes. Understanding that credit scores vary by source, fluctuate naturally, and are only one factor among many shifts the focus towards responsible financial management and informed borrowing decisions.