London, November 28, 2025

The UK government has introduced a new pay-per-mile tax on electric vehicles, announced in the 2025 Budget, aiming to address declining fuel duty revenues and fund road maintenance. The charge of 3 pence per mile applies to electric vehicles, with hybrids taxed at half that rate, starting in England.

Details of the Pay-Per-Mile Tax

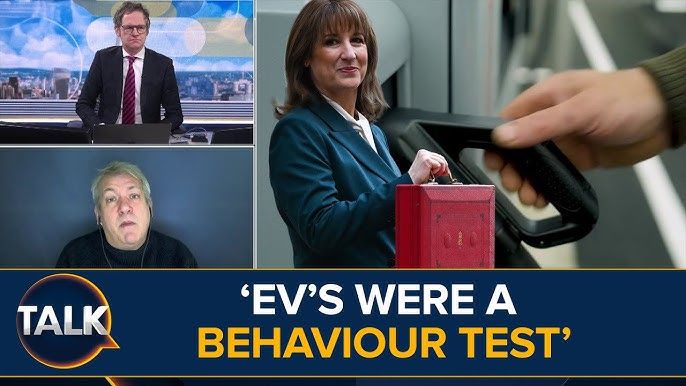

The new policy establishes a tax rate of 3p per mile for electric vehicles (EVs) and 1.5p per mile for plug-in hybrid vehicles. This will be levied annually alongside existing vehicle excise duties. The measure, introduced by Chancellor Rachel Reeves, represents a government effort to recoup lost revenues due to increased EV adoption, which reduces traditional fuel duty income.

Financial Impact on EV Owners

The tax will noticeably affect EV owners’ annual costs. For example, an electric vehicle driver covering 8,500 miles per year would incur around £255 in additional tax. While this is a new expense for EV users, it remains approximately half the fuel tax burden faced by comparable petrol or diesel drivers. This differential aims to maintain fairness while transitioning the tax base away from fossil fuels.

Policy Objectives and Funding Goals

Revenue raised from the pay-per-mile charging scheme is earmarked for enhancing road infrastructure in England. Forecasts anticipate the tax will generate about £1.1 billion by the fiscal year 2028-2029, rising to nearly £1.9 billion by 2030-2031. This funding is intended to sustain and improve road maintenance as vehicular technology and energy sources evolve. The approach signals a policy pivot from fuel consumption-based taxation to usage-based models that reflect current automotive trends.

Market and Behavioral Implications

This new tax introduces considerations for EV consumers and the automotive market. Some EV owners may reassess the overall cost-benefit of electric vehicles given the additional mileage fee. However, other financial incentives for EVs remain in place, potentially mitigating some impact. Notably, while this UK policy charges EV owners directly, business mileage reimbursement practices, such as the 70 cents per mile rate in the U.S. for 2025, continue to reward detailed mileage tracking and can offer substantive benefits to commercial drivers regardless of vehicle type.

Global Policy Trends in Response to EV Adoption

The introduction of a pay-per-mile tax in the UK reflects a wider global trend as governments adapt taxation frameworks to align with evolving technologies and energy infrastructures. As EV adoption accelerates and fuel duties diminish, usage-based taxation models may become increasingly common to ensure sustainable infrastructure funding while supporting the transition to low-emission vehicles. Such changes are poised to influence policymaking, consumer choices, and the automotive market internationally.

The UK’s move to implement a mileage-based tax underscores ongoing efforts to balance environmental incentives with fiscal responsibility, marking a significant shift in how road users contribute to infrastructure costs in the era of electric mobility.