London, December 08, 2025

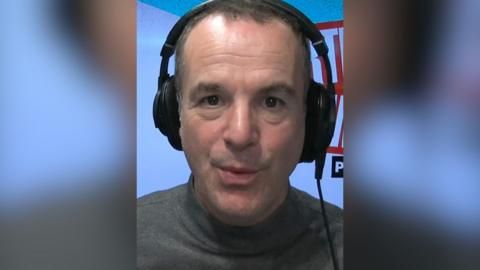

Financial expert Martin Lewis has clarified widespread misconceptions about credit scores, emphasizing that these scores are neither fixed nor universal, and debunking the myth of an official credit blacklist used by lenders across the UK. His insights aim to correct common misunderstandings impacting consumers and financial professionals.

Credit Scores Vary Among Agencies and Lenders

Credit scores are provided by three main credit reference agencies—Equifax, TransUnion, and Experian—and each produces a different score based on varying methodologies. Moreover, lenders do not rely on a single standard score but use proprietary models that consider a broad range of factors beyond credit history. This diversity means that a consumer’s credit score can vary substantially depending on the agency and lender involved.

Small Score Movements Often Lack Significant Impact

Lewis highlights that minor fluctuations in credit scores—such as drops of around 20 points—are generally not a cause for alarm. Because lenders weigh individual factors differently, such small changes usually do not affect lending decisions materially. For instance, closing an unused credit card can be interpreted positively by some lenders and negatively by others, illustrating the subjective nature of credit assessment.

Affordability Checks: A Critical Factor in Lending Decisions

More important than the credit score alone is the affordability assessment, which compares income with outstanding debts to evaluate repayment capacity. Lewis stresses that lenders prioritize this income-to-debt ratio heavily when approving loans. This means a strong credit score may not guarantee loan approval if the borrower’s financial situation shows limited repayment ability.

Debunking the Credit Blacklist Myth

Contrary to popular belief, there is no official or formal “credit blacklist” that restricts individuals from accessing credit indefinitely. While repeated loan application rejections can negatively impact credit records, Lewis affirms that being blacklisted is a misconception. Consumers should understand that creditworthiness is assessed continuously and dynamically, rather than by a simplistic binary blacklist status.

Understanding Credit Scores as Fluid and Approximate

Lewis advises consumers and professionals to treat credit scores as fluid, approximate indicators rather than as absolute or infallible metrics. They serve as a snapshot of how lenders might view credit risk but are only one element among many evaluated. He recommends focusing on broader financial health, addressing significant changes, and maintaining responsible credit behavior instead of overemphasizing minor score variations.

By providing a nuanced understanding of credit scoring realities, Martin Lewis’s clarifications encourage informed decision-making among business leaders, policymakers, and consumers alike. As credit assessment processes evolve, grasping these complexities is essential to navigate lending landscapes effectively.