London, November 21, 2025

Economics columnist Aditya Chakrabortty criticizes the left’s recent push for a wealth tax in the UK, arguing it will achieve minimal results in addressing economic inequality despite widespread calls for reform in November 2025.

Chakrabortty’s Analysis of the Wealth Tax Proposal

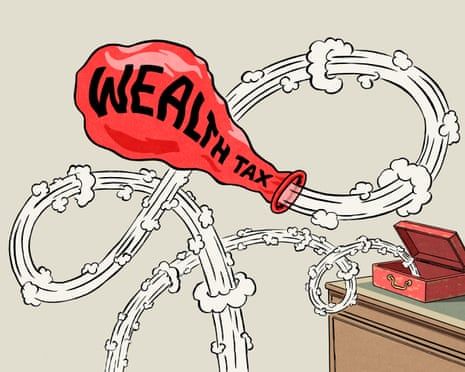

In his recent commentary, Chakrabortty highlights that while the left champions a wealth tax as a tool to redistribute wealth and reduce inequality, the policy is unlikely to make a meaningful impact. He describes the wealth tax as largely symbolic, falling short of tackling the structural economic disparities that have deepened over the past four decades. This limited practical effect raises questions about its viability as a central solution to the growing wealth gap.

The Left’s Rationale and Broader Debate

Advocates on the left argue that a wealth tax would serve as an essential mechanism to redistribute wealth from the super-rich to the wider population, helping to curb rising economic imbalances. Figures like Richard Murphy acknowledge the challenges in implementing such a tax but maintain that it remains necessary given current levels of inequality. Conversely, critics including Dan Needle, as referenced in media commentary, dismiss wealth taxation as impractical and ineffective, suggesting it fails to deliver the promised fiscal or social benefits.

Structural Inequality Beyond Taxation

Chakrabortty urges policymakers and the public to recognize that wealth taxation alone cannot address the root causes of inequality. He underscores that gross economic disparities stem from broad structural factors that require far-reaching social policies and significant investments in public services. Narrow measures such as a wealth tax risk offering only superficial remedies without systemic change.

Significance and Ongoing Discourse

The article contributes to a vital conversation within the UK’s political economy regarding how best to confront wealth concentration and social justice. It reflects the tension between symbolic policy measures and pragmatic reforms, urging a shift toward comprehensive approaches to reduce inequality. Chakrabortty’s perspective has sparked renewed debate among economists, policymakers, and civil society, highlighting the complexities in designing effective economic policies amid a fractured political landscape.

This discourse over wealth tax efficacy comes at a time when the UK faces sustained public pressure to tackle economic inequality with meaningful action rather than symbolic gestures, shaping policy discussions in the months and years ahead.